Nifty 50 Market Outlook – 22nd September 2025

Market View

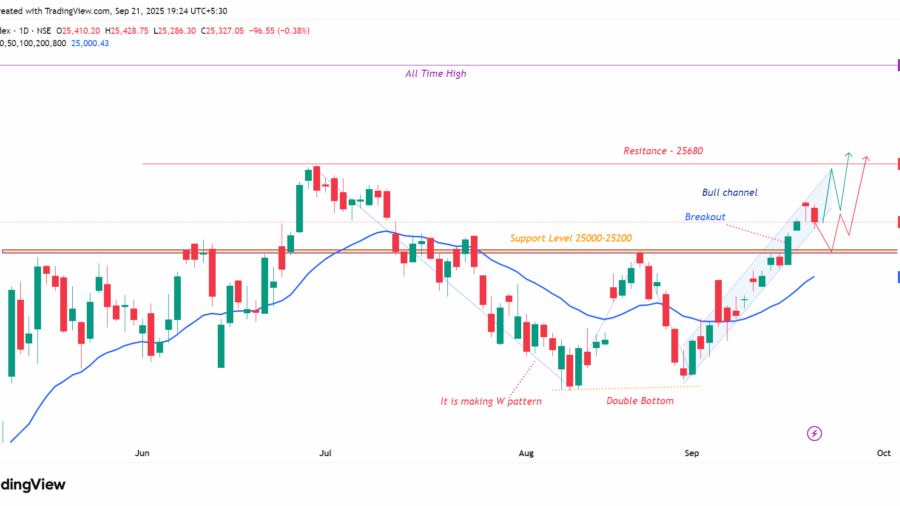

- Overall Trend – Nifty continues to trade within a bullish channel, maintaining its broader upward momentum. Despite short-term volatility, the underlying trend remains positive.

- Key Resistance – The index is likely to challenge the 25,680 level, which is emerging as the next major hurdle on the upside. A breakout above this level could accelerate bullish momentum further.

- Crucial Support Zone – The 25,000 level is acting as a strong support. While the market may retest this level, it is unlikely to be broken easily unless there is a major negative trigger.

- Significance of 25,000 Breakout – The recent breakout above 25,000 came after 64 trading sessions, reinforcing the strength of this move. This suggests that Nifty is likely to sustain above 25,000 in the near term.

- Candle Pattern & Near-Term View – The last two daily candles were bearish, with the most recent bar closing near its low—indicating some profit booking. However, the next candle will be crucial:

- If Nifty closes around 25,300 with a bullish bar, the index may resume its upward journey and attempt to break 25,676–25,680.

- If selling pressure continues, the market could revisit the 25,000 support zone before attempting a fresh rebound.

Trading Strategy for the Coming Weeks

- Long Setup – If the next trading session forms a bullish candle, traders can look to go long. The upside target for the coming weeks is 25,800.

- Short Setup – If the market breaks below 25,300 or sustains under this level, short positions can be considered. The first downside target would be 25,000.

If 25,000 is broken decisively, the sentiment will likely shift to bearish, and the index may extend the fall towards 24,500.

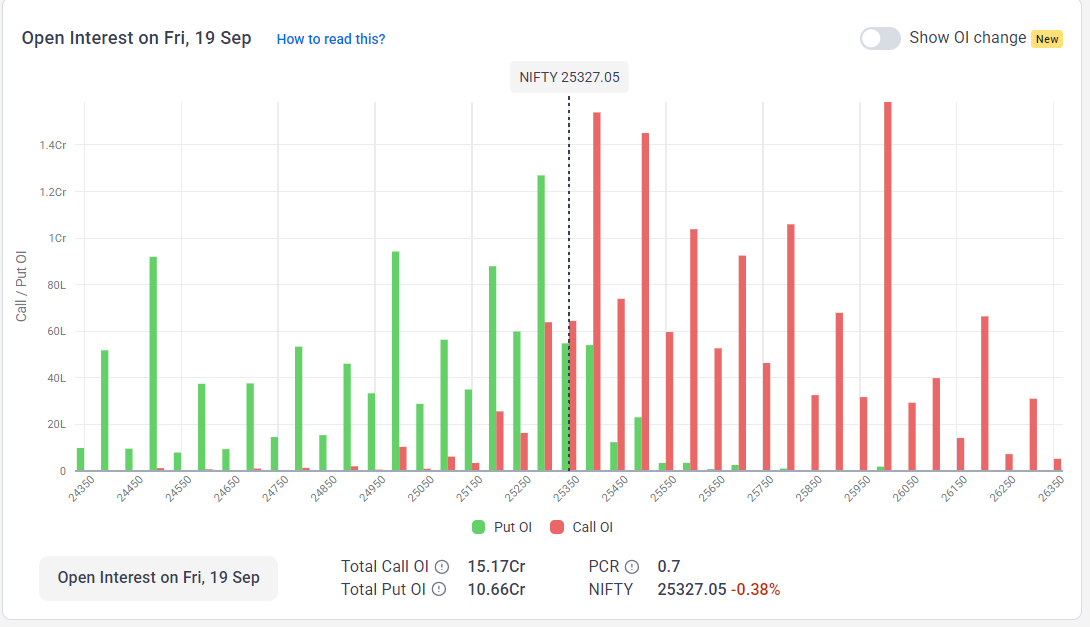

Open Interest Analysis – Nifty 50 (Weekly & Monthly Expiry)

For 23rd September 2025 Expiry (Weekly Setup)

- Support at 25,300: Around 0.27 Cr puts vs. 0.63 Cr calls. This level won’t break easily on Monday, but if it does, the market may slide towards 25,200.

- Strong support at 25,000: With 87L puts vs. 25L calls, traders believe the market will hold this level in the short term.

- No major call buildup between 24,500 – 25,300: This suggests FIIs & DIIs are not expecting a strong bearish move.

- Resistance at 25,400: With 1.54 Cr calls vs. 54L puts, this is the first hurdle for the bulls.

- Resistance at 25,500: With 1.45 Cr calls vs. 23L puts, a key barrier.

- Major resistance at 26,000: With 1.58 Cr calls vs. only 1.89L puts, this is where bears have built heavy positions, expecting the market not to cross this level easily.

For 30th September 2025 Expiry (Monthly Setup)

- Support at 25,000: With 57L puts vs. 33L calls, this level is well protected by put writers.

- Resistance at 25,500: With 56L calls vs. 28L puts, but given the bullish structure, this level can be breached if momentum continues.

- Major resistance at 26,000: With 63L calls vs. 13L puts, this remains a critical ceiling for the monthly trend.

Market Outlook Based on OI Data

- Short-Term (22nd–23rd Sep) – The market may remain sideways to slightly bearish ahead of the weekly expiry, mostly consolidating below 25,500.

- Gap Moves – Any gap-up or gap-down opening could trigger momentum either way (bulls or bears).

- Bullish Setup – A breakout above 25,400 can fuel bullish momentum, with potential to test 25,500–25,680 levels.

- Bearish Setup – If the market closes or trades below 25,300, a retest of 25,000 is likely. A decisive break of 25,000 could extend weakness towards 24,500.

Sentiment Indicators

- PCR Ratio: 0.8 – This indicates more call writing than put writing, showing short-term bearish sentiment. If PCR rises above 1.0, it would reflect a shift towards bullish positioning.

- India VIX: 10 – Low volatility, no signs of panic. Investors remain calm, suggesting the market may trade in a controlled range without sharp whipsaws.

How to Take Positions in the Coming Week

1. Futures Trading Setup

- Long Setup: Go long on Nifty if it closes above 25,400 or forms a strong bullish candle. The immediate upside target will be around 25,700.

- Short Setup: Go short if Nifty closes below 25,300. In that case, expect a move down to 25,000, as the index may retest this crucial support level.

2. Options Buying Strategy

- Put Buying (Bearish Setup):

If Nifty breaks the previous day’s low within the first 15 minutes of trade, buy an ATM 25,300 Put.

Target: 25,200 (same-day move)

Returns: Aim for 60–80 points on Nifty (20%+ return on capital).

Important: Do not carry this position overnight; exit within the same session.

- Call Buying (Bullish Setup):

If Nifty opens with a gap-up and trades above 25,350, or if the market starts with a strong bullish bar, buy an ATM Call for intraday trading.

Exit Strategy: Book profits after the first upward move, ideally capturing 50–60 points on Nifty.

Important: Do not hold overnight, as theta decay will reduce option value.

Disclaimer: This content is for educational purposes only and not financial advice. Options trading carries risk. Consult a registered advisor before making any trades. We are not liable for any losses