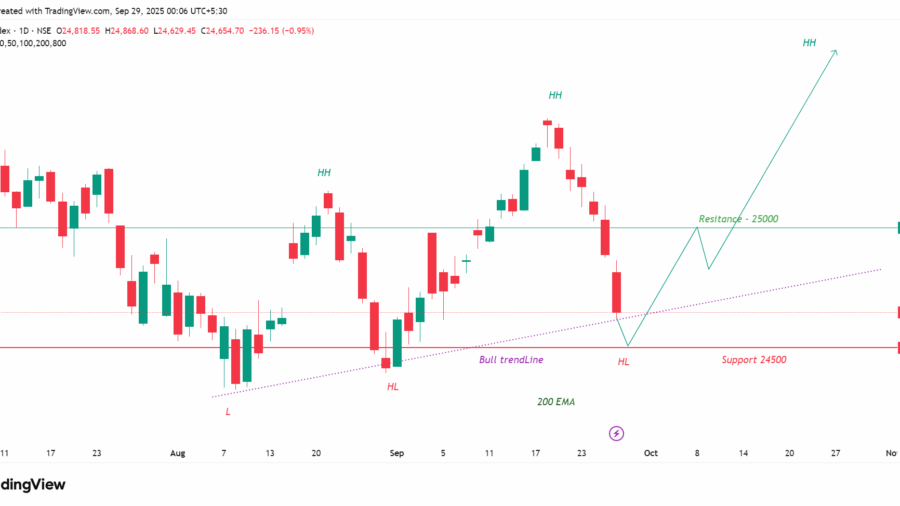

Nifty 50 Market Outlook for September 29, 2025

The Nifty 50 ended last week under continued selling pressure, with the index slipping nearly 1 percent on September 26 and losing 2.65 percent for the week. This marked the sixth straight session of weakness, highlighting strong bearish sentiment across both technical and momentum indicators.

The index touched the 24,600 mark, which aligns with the 78.6% retracement level of the recent rally. This area now serves as a crucial support zone that could decide the near-term direction of the market.

Key Levels to Watch

- Support Zones:

Immediate support is seen at 24,600, followed by 24,400–24,300 if the decline extends. The 24,500 zone also remains important, as a successful retest and reversal from this level could help the index resume its broader bullish structure. On the daily chart, the pattern continues to show Higher Highs (HH) and Higher Lows (HL), and the market is currently awaiting the formation of the next Higher High to confirm the continuation of the trend. - Resistance Zones:

On the upside, resistance is expected in the 24,800–24,900 zone. A decisive close above these levels will be required for bullish momentum to return with strength.

Market Sentiment

While the trend remains under pressure in the short term, the recent steep fall increases the possibility of a bounce-back. However, the sustainability of any recovery will be crucial—if buyers fail to defend the 24,600–24,500 support region, the market could shift toward a deeper corrective phase.

In summary, the market’s next move hinges on how Nifty behaves around the 24,600–24,500 support cluster. Holding above this range could revive bullish momentum, but a breakdown may open the door for further downside toward 24,300.

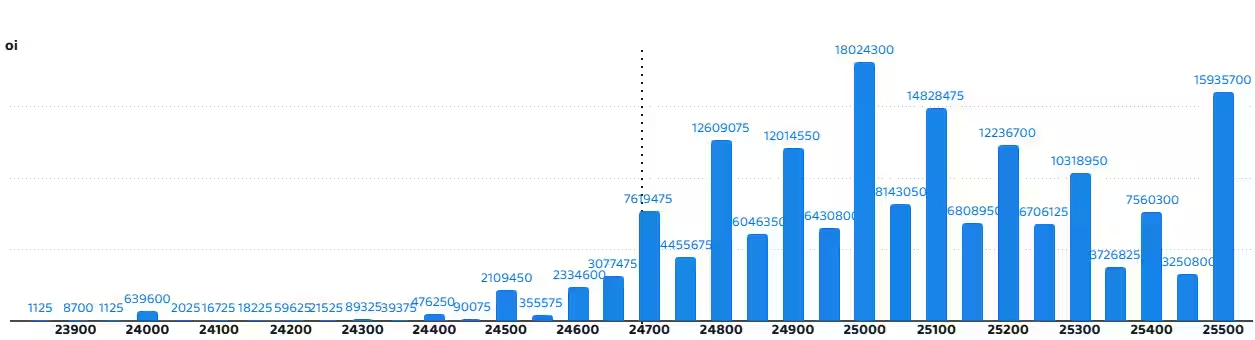

Nifty Open Interest Analysis – September 29, 2025

Call Options Data

- The maximum Call OI is concentrated at the 25,000 strike (1.8 crore contracts), making it the most significant resistance level in the near term.

- This is followed by the 25,500 strike (1.59 crore contracts) and the 25,100 strike (1.48 crore contracts), indicating additional supply zones where sellers are active.

- Fresh Call writing was most notable at the 24,800 strike (1.07 crore contracts added), suggesting traders are building positions expecting Nifty to face resistance near this zone.

- Additional writing was seen at 24,900 (75.83 lakh contracts) and 24,700 (62.41 lakh contracts).

- On the other hand, Call unwinding was observed at the 25,400 strike (-21.24 lakh contracts), followed by 25,450 (-14.63 lakh) and 25,350 (-11.03 lakh), showing that traders are reducing positions at higher levels, hinting at a lack of confidence in a sharp breakout.

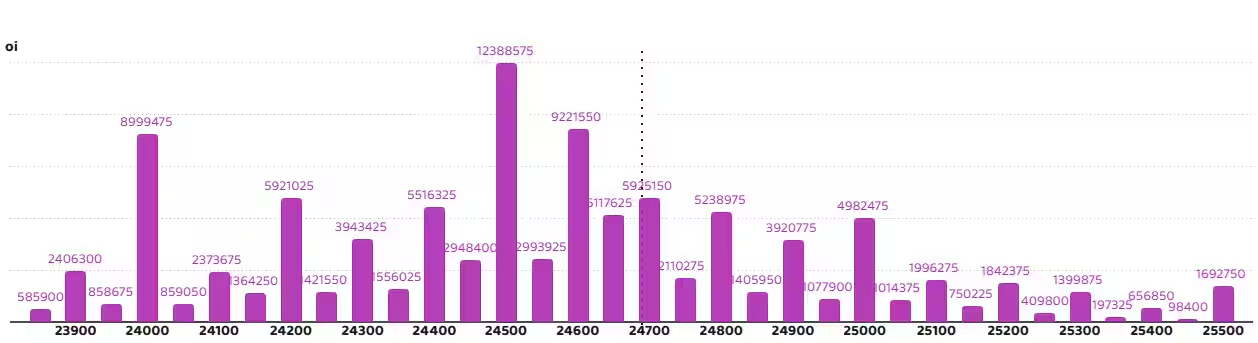

Put Options Data

- On the downside, the 24,500 strike holds the highest Put OI (1.23 crore contracts), acting as a key support level for the index.

- This is followed by the 24,600 strike (92.21 lakh contracts) and the 24,000 strike (89.99 lakh contracts), which further strengthen the support base.

- Put writing was strongest at 24,500 (+41.98 lakh contracts), showing traders’ confidence in defending this level.

- Additional writing was recorded at 24,600 (+38.91 lakh contracts) and 24,650 (+29.38 lakh contracts), reinforcing the support zone.

- Put unwinding was highest at 24,900 (-45.61 lakh contracts), followed by 25,000 (-43.26 lakh contracts) and 24,800 (-25.68 lakh contracts), reflecting weakening bullish bets at higher strikes.

Market View Based on OI Analysis

- Support Zone: The 24,500–24,600 range is emerging as the strongest support, with heavy Put OI and fresh writing. Unless this zone is broken, downside risks remain limited in the short term.

- Resistance Zone: On the upside, resistance is firm around 24,800–25,000, where significant Call OI and fresh writing are concentrated.

- Trading Implication:

- If Nifty sustains above 24,600, it may consolidate and attempt a move toward 24,800–25,000.

- A breakout above 25,000 could open the way toward 25,100–25,500, but the heavy Call OI here suggests it won’t be an easy move.

- On the downside, if Nifty slips below 24,500, the next support lies near 24,300–24,000, which could invite stronger selling pressure.

Put-Call Ratio (PCR) Update

The Nifty Put-Call Ratio (PCR) slipped to 0.63 on September 26, the lowest since July 28, down from 0.68 in the previous session.

The PCR is an important sentiment indicator:

- A high PCR (above 0.7 or near 1.0) means traders are adding more Puts than Calls, which usually signals bullish sentiment as participants expect the market to stay supported.

- A low PCR (below 0.7 or closer to 0.5) shows more Call positions being built compared to Puts, reflecting bearish sentiment as traders anticipate resistance or downside pressure.

With PCR now at 0.63, the data suggests that the market mood is leaning bearish in the short term.

India VIX Update

The India VIX, which reflects expected market volatility, rose by 5.96% to 11.43. It has now moved back above its short- and medium-term moving averages.

This rise in VIX signals increasing caution in the market, showing that traders and investors expect more volatility ahead. For bulls, it suggests being careful as the risk levels are starting to rise.

Disclaimer: This content is for educational purposes only and not financial advice. Options trading carries risk. Consult a registered advisor before making any trades. We are not liable for any losses.