1. Avoid ATM & OTM Options for Long-Term Consistency

ATM and OTM call/put options are generally not profitable in the long run. Their deltas (0.40–0.55 range) do not move in sync with Nifty price action. Because of this:

- Option premiums move too fast and become highly impulsive.

- Manual trading makes it difficult to exit exactly at target or stop-loss.

- When the market moves against you, losses rise quickly and psychologically it becomes difficult to exit.

- High risk–reward ratio means in Option more volatility and more emotional decision-making.

2. Trade Futures Using Deep ITM Options

Instead of trading ATM/OTM, use Deep ITM options as a substitute for futures.

- You can trade with lower capital compared to Nifty futures.

- Deep ITM behaves almost like futures but with lower risk.

- Price moves more smoothly, reducing emotional pressure.

3. Choose Deep ITM Options With Delta 0.60, 0.70, 0.80, 0.90 +

These deltas move almost point-to-point with Nifty, allowing:

- Better accuracy in targets

- Lower chances of hitting stop-loss

- A smoother and more predictable move that matches Nifty candles

Take minimum 2-strike deep ITM options from the ATM for both calls and puts so that the price movement aligns with the Nifty chart.

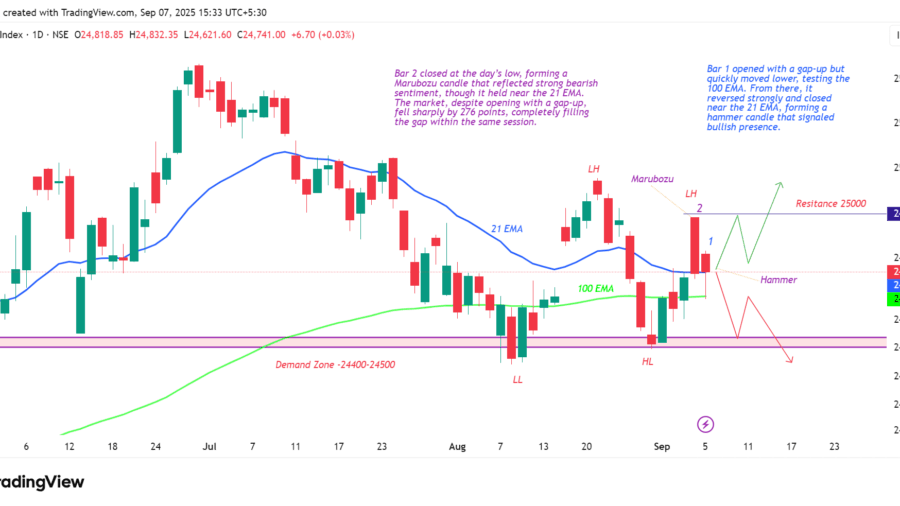

4. Set Targets & Stop-Loss Based on Nifty Price Action

If your option delta is 0.6–0.9:

- Keep your profit target 3–4 points below Nifty’s actual price target.

- Place your stop-loss 3–4 points above or below the Nifty candle structure.

- Use candle logic (3–4 bars above/below) to place stop-loss safely.

This ensures controlled risk and better reward consistency.

5. Trade Only in High-Probability Sessions

Avoid full-day trading. Focus on these time windows:

- Morning Session: 9:15 AM – 11:00 AM

- Afternoon Session: 1:30 PM – 3:00 PM ( AS The UK Market Open At 1:30 PM )

Avoid 11:00 AM – 1:00 PM, as the market usually moves sideways during this period.

6. Avoid Counter-Trend Trades

Do not trade against the trend.

- If the market is bullish, avoid taking put (counter-trend) trades.

- If the market is bearish, avoid taking call (counter-trend) trades.

Options premiums move strongly in the direction of the trend. Counter-trend trades reduce your long-term profitability and increase losses.

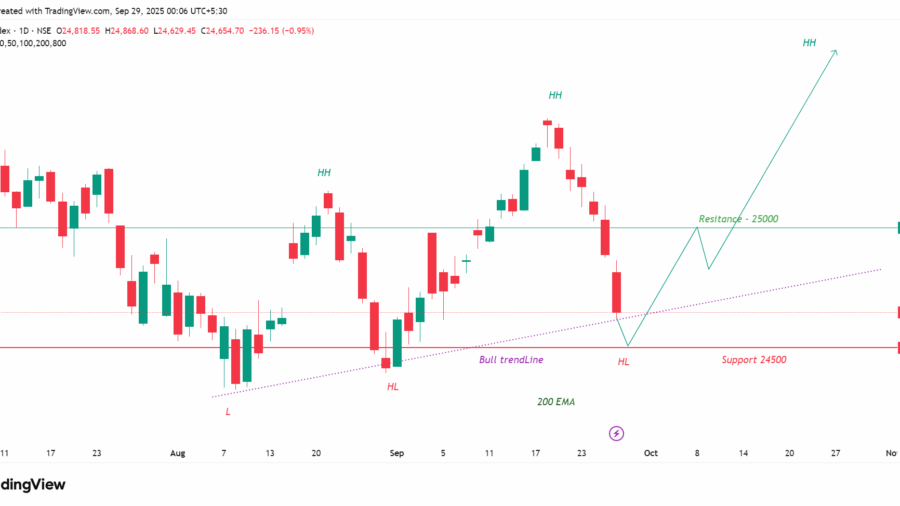

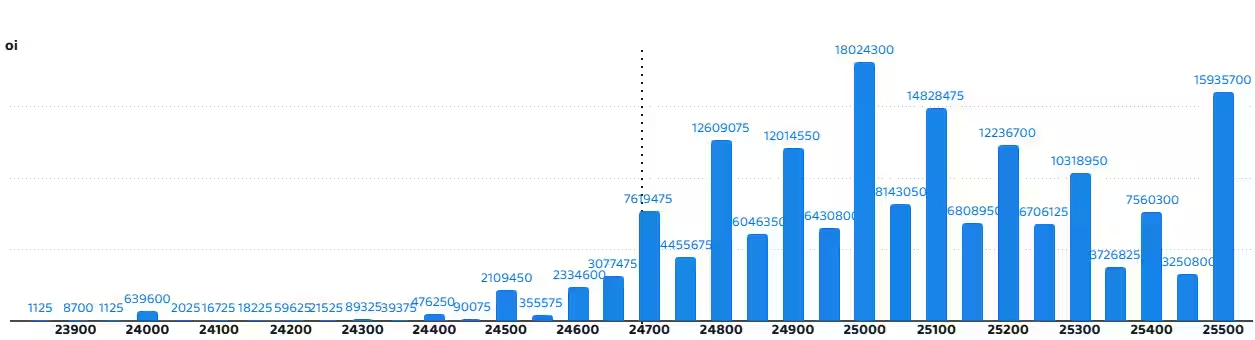

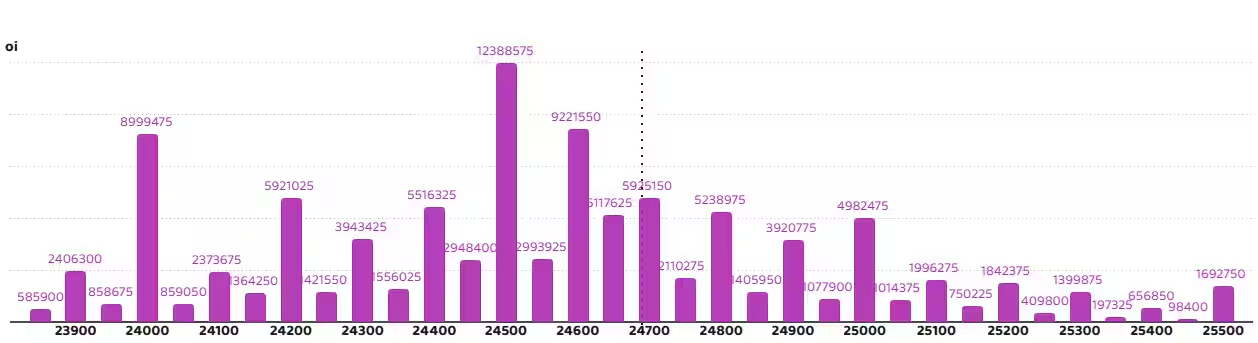

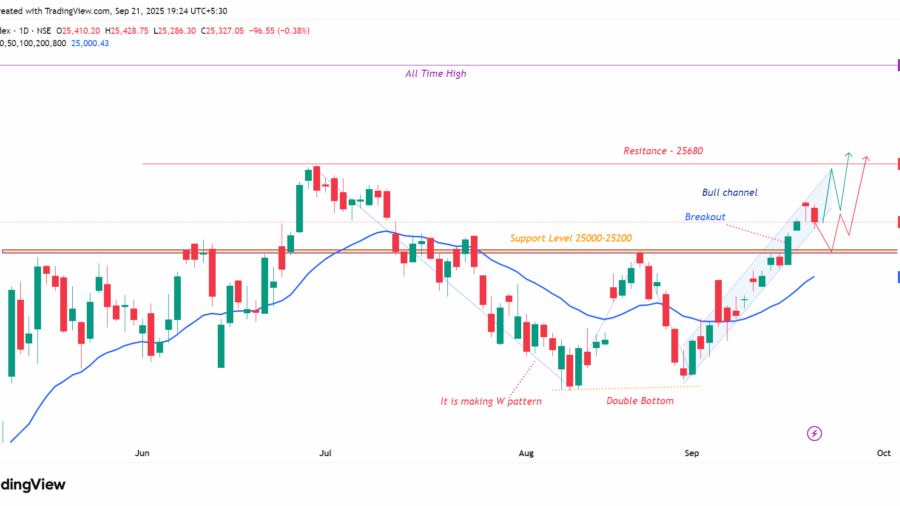

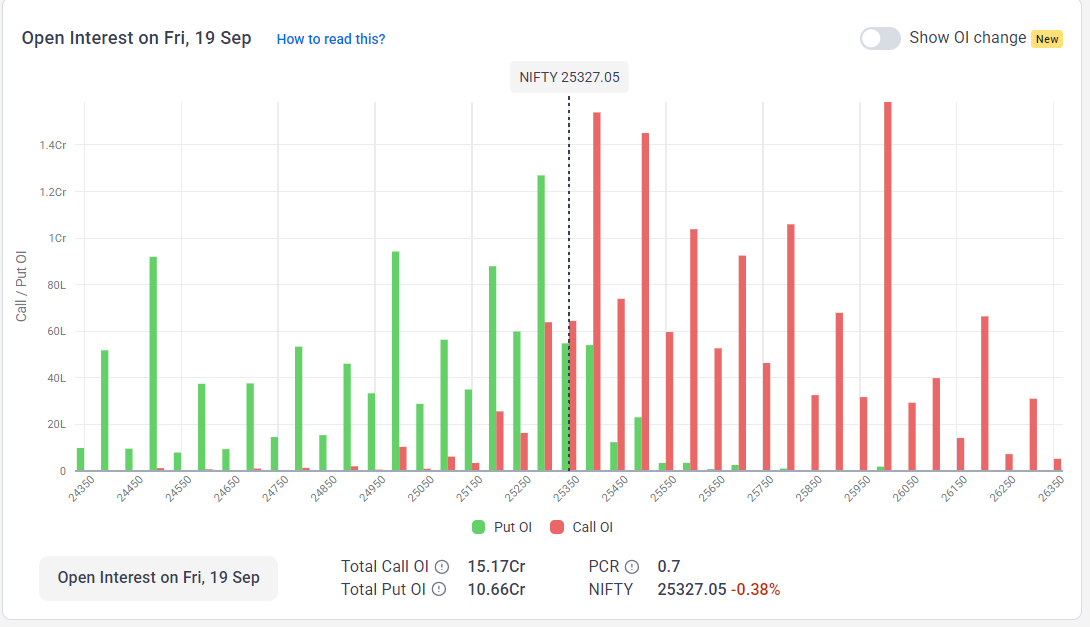

7. Option Chain Analysis for Support & Resistance

Use Option Chain data to identify real support and resistance levels:

- Highest Call OI → Major resistance

- Highest Put OI → Major support

Also check Day OI change:

- Call unwinding → Bulls gaining strength

- Put unwinding → Bears gaining strength

Analyze the OI shifts during the last 5, 15, and 30 minutes to understand short-term trend direction.

8. Use PCR Ratio to Judge Trend Strength

PCR (Put–Call Ratio) helps identify market sentiment:

- Rising PCR (above 0.6–0.8) → Market turning bullish

- Falling PCR → Bearish pressure increasing

- PCR around 1 → Market in a range or sideways; avoid trading

PCR should support your trend bias before you take a trade.

9. Do Not Enter in the First 5 Minutes

Avoid entering trades during the first 5 minutes of the market open because volatility is unpredictable.

Also:

- Do not take advance entries before Nifty breaks out.

- Options Premium break out faster than Nifty Move , so wait for confirmation in the Nifty chart first.

- Enter after Nifty confirms, not before.

10. Follow Your Own Strategy – Avoid Overtrading

- If you have a strategy with more than 60% accuracy, follow it strictly without deviation.

- Limit yourself to 2 trades per day (maximum 3 only if one setup fails).

- Your goal should be to capture 30–40 points from the Nifty move in every two sessions combined. But remember — you don’t need to trade all 5 days of the week.

- Avoid sideways marketsbecause theta decay kills option premiums, and price movement becomes limited.

- Do not overtrade. Unnecessary trades reduce accuracy and increase the chances of losses.

Disclaimer: This content is for informational and educational purposes only and should not be considered as financial advice. Investing and trading in the stock market involve risks, and you should always consult a registered financial advisor before making any investment decisions. We do not accept any responsibility for losses that may arise from acting on this information.