Nifty 50 Outlook Ahead of Union Budget

The Nifty 50 witnessed mild profit booking on January 30 after a three-day recovery, as traders preferred to stay cautious ahead of the Union Budget on February 1. Despite the consolidation, trading volumes remained strong for the fourth consecutive session, indicating active participation rather than panic selling.

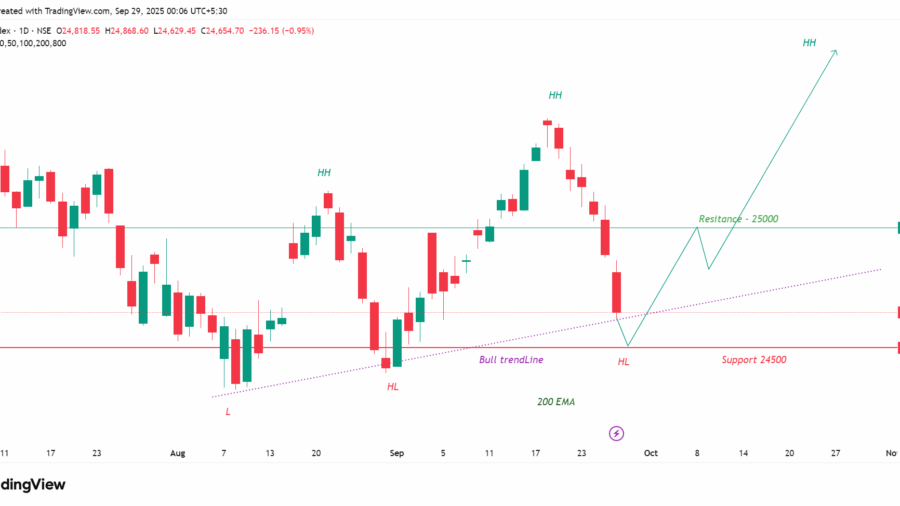

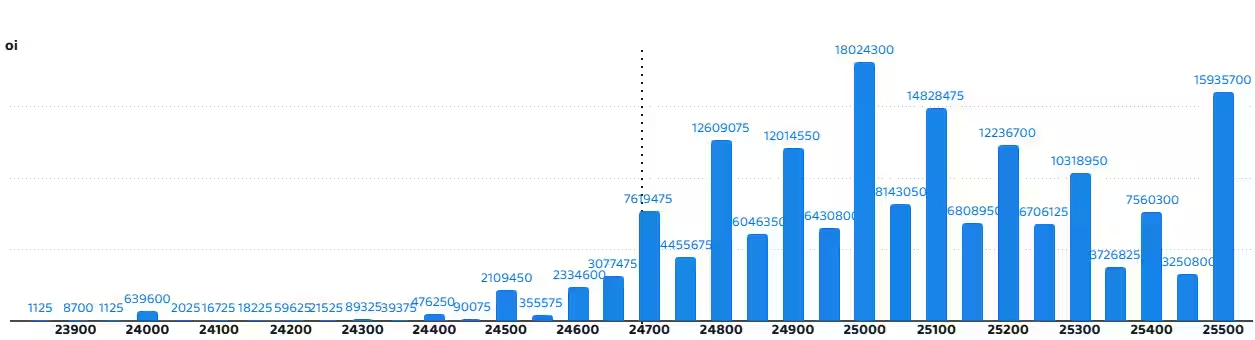

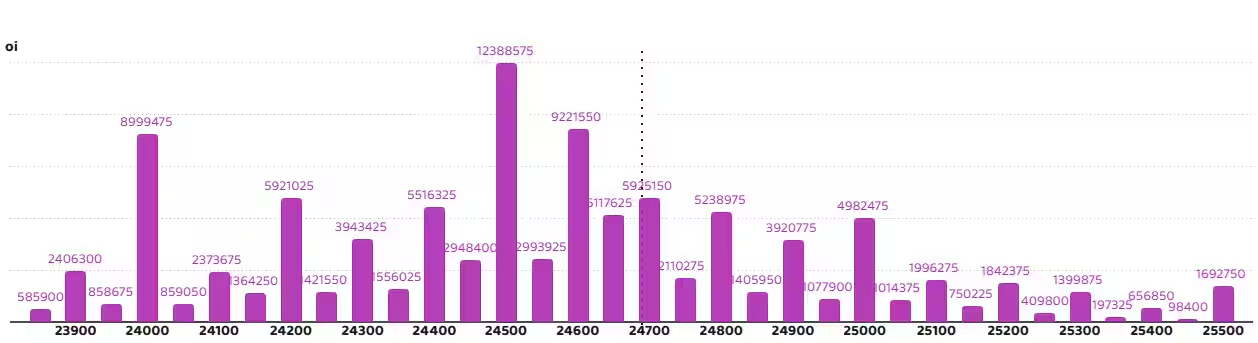

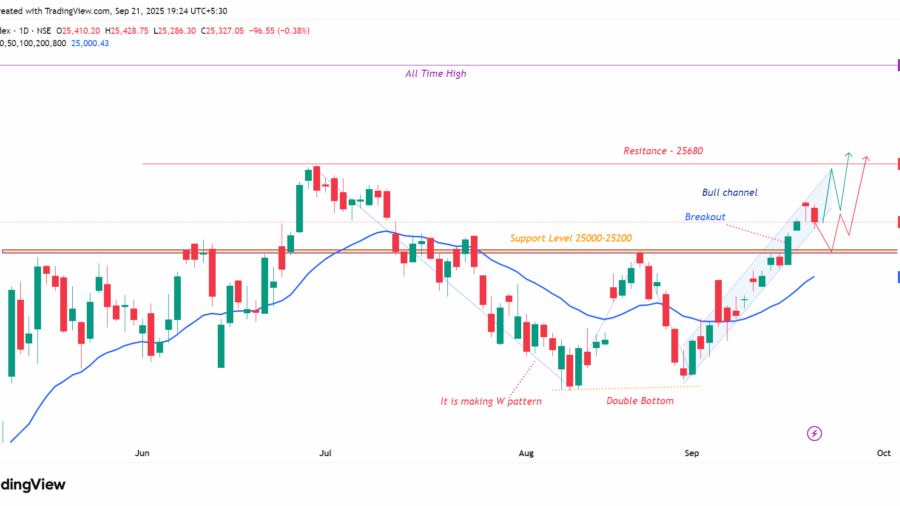

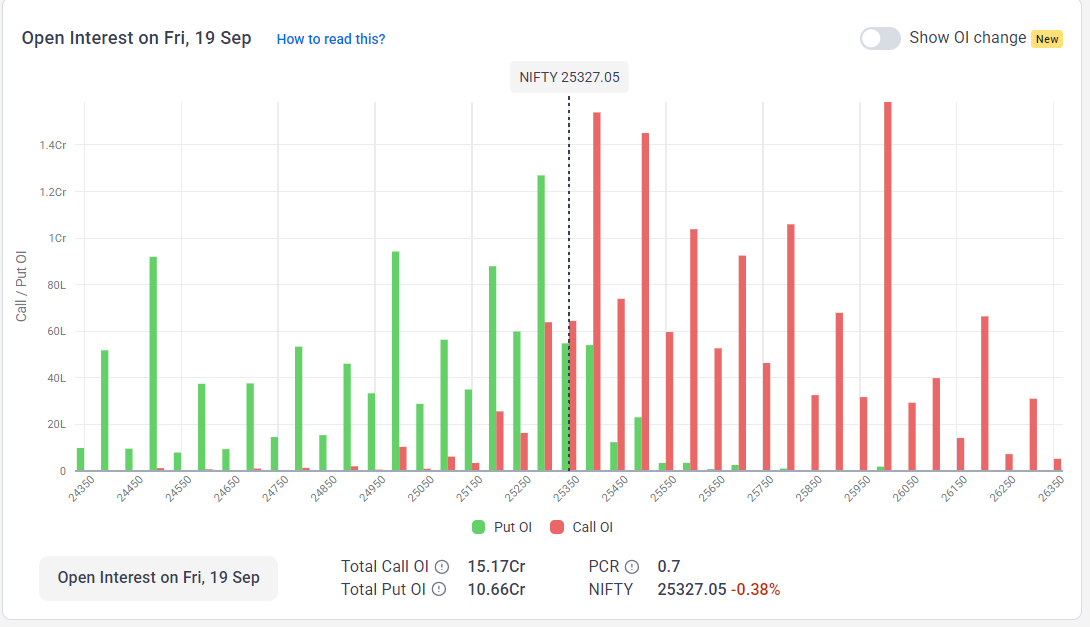

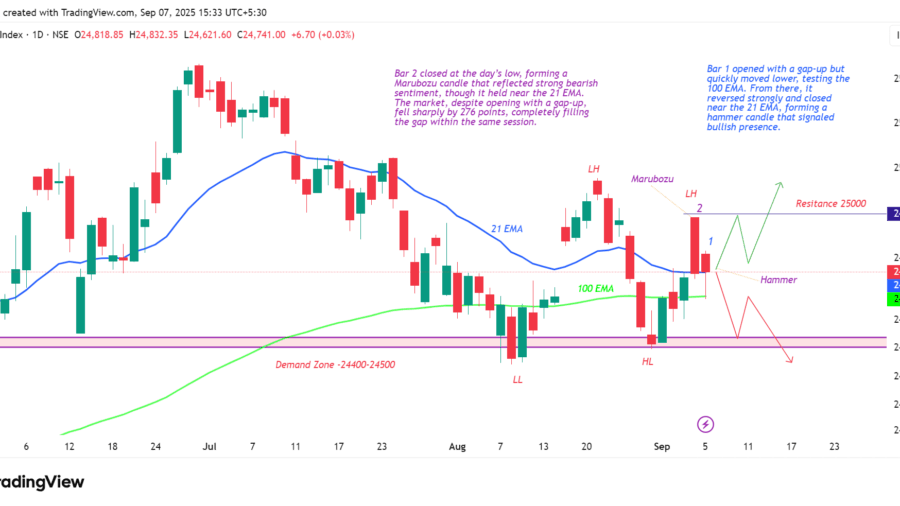

Momentum is improving gradually, but it is yet to turn decisively bullish. A strong upside move will only be confirmed if the index sustains above the 25,650–25,700 resistance zone. Until then, the market is likely to remain range-bound.

Expected Trading Range

For the next session, the Nifty is expected to trade between 25,000 and 25,500:

- A decisive breakout above 25,500 could open the door toward 25,700.

- A breakdown below 25,000 may invite fresh selling pressure and bring bears back into control.

What Analysts Expect From This Budget

Though the official text isn’t released yet, expectations from economists include:

- Focus on fiscal discipline with limited room for large stimulus.

- Structural reforms rather than big spending boosts.

- Possible emphasis on labor reforms, manufacturing, and investment attraction.

- Fiscal deficit management and prudent borrowing targets.

This means markets may look for clarity on growth support and business incentives rather than broad headline promises.

Market Conditions Going Into Budget

- Recent sessions showed defensive positioning, with weakness in IT and metal stocks as traders booked profits ahead of Budget announcements.

- Foreign Institutional Investors (FIIs) have been net sellers at times, which has been a headwind for markets recently.

- FIIs will be watching: 1. tax policy clarity 2. fiscal outlook 3. structural reforms ⇒ Their flows can drive strength or weakness post-Budget.

Sectors / Stocks Likely in Focus

While specific budget measures will drive stock moves, certain themes often see strong reactions:

1) Financials (Banks, NBFCs)

- Sensitive to fiscal policy, credit growth outlook and government borrowing plans.

- Watch HDFC Bank, ICICI Bank, SBI for shifts after Budget cues.

2) Consumption / FMCG

- Tax reliefs or boosts to rural/urban consumption can lift demand plays.

- Look at HUL, Nestlé India, Dabur.

3) Infrastructure / Capital Goods

- Budget support for capex can drive broader economic growth.

- Stocks like Larsen & Toubro, construction catalysts could react.

4) Energy and Auto

- EV incentives, fuel taxes or infrastructure outlays may matter here.

- Consider players like Reliance Industries, Maruti Suzuki, Tata Motors.

(These are examples — actual reactions depend on announced policies.)

FII Action and Market Strategy

Before Budget:

- Position size reduced and watch global cues (USD strength, U.S. Fed direction).

- Technical levels around Nifty’s recent support/resistance are key for bias.

On Budget Day:

- Expect volatile sessions — use defined risk strategies.

- Avoid overleveraging ahead of key announcements during the speech.

Post Budget:

- Once markets digest the details (after 24–48 hrs), sector rotation tends to start.

- Follow FII flow data to confirm trend direction — fresh buying often signals broader rally potential

Nifty 50’s performance on Budget Day (typically February 1) reveals a high-volatility environment where intraday swings often far exceed the final closing percentage.

Since 2017, the Union Budget has been presented on February 1 (previously it was the last working day of February). Below is the data for the Nifty 50 from 2016 to 2025:

Key Takeaways from the Decade

- Biggest Gain: 2021 saw a massive +3.80% surge (approx. 646 points from previous close) as markets cheered the absence of new taxes and a push for infrastructure.

- Biggest Fall: 2020 saw a sharp -2.32% drop, largely due to the introduction of a new tax regime and disappointment over lack of direct stimulus.

- Intraday Volatility: Even on days like 2023 where the close was only -1.10%, the market swung over 600 points between the high and the low.

- The “Flat” Trend: Since 2022, the closing moves have become relatively muted (less than 1%), though the intraday “wicks” (high-low difference) remain large.

Conclusion

The Union Budget should be viewed as a volatility catalyst rather than an immediate trend changer. While sharp intraday swings are likely during the Finance Minister’s speech, sustainable market direction typically emerges only after the full details are digested and institutional flows confirm conviction.

For traders and investors, discipline is critical—respect key technical levels, avoid overleveraging, and wait for confirmation from FII activity. The real opportunity often unfolds 24–48 hours post-Budget, when sector rotation begins and clearer trends develop. Staying patient, selective, and risk-aware will be more rewarding than chasing headline-driven moves.

Disclaimer: This content is for informational and educational purposes only and should not be considered as financial advice. Investing and trading in the stock market involve risks, and you should always consult a registered financial advisor before making any investment decisions. We do not accept any responsibility for losses that may arise from acting on this information.