Nifty 50 Outlook: Why the Market Is Falling and What Traders Should Do Next

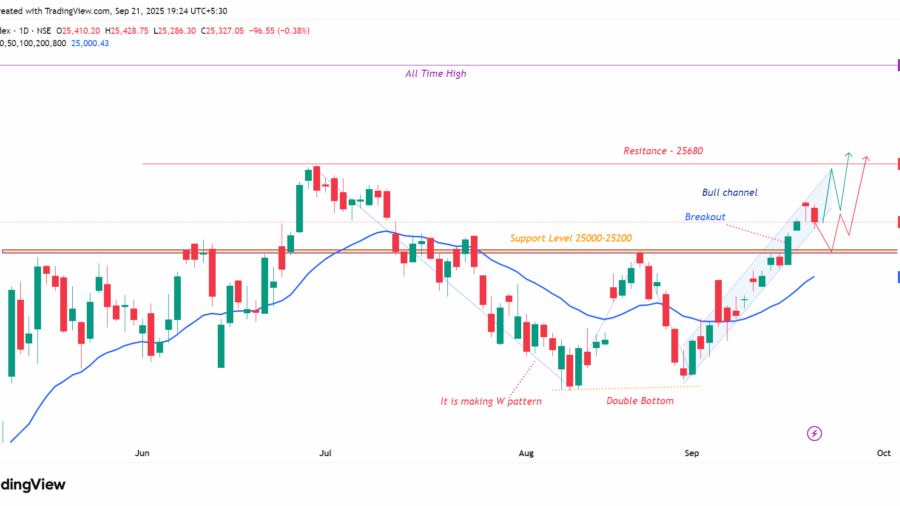

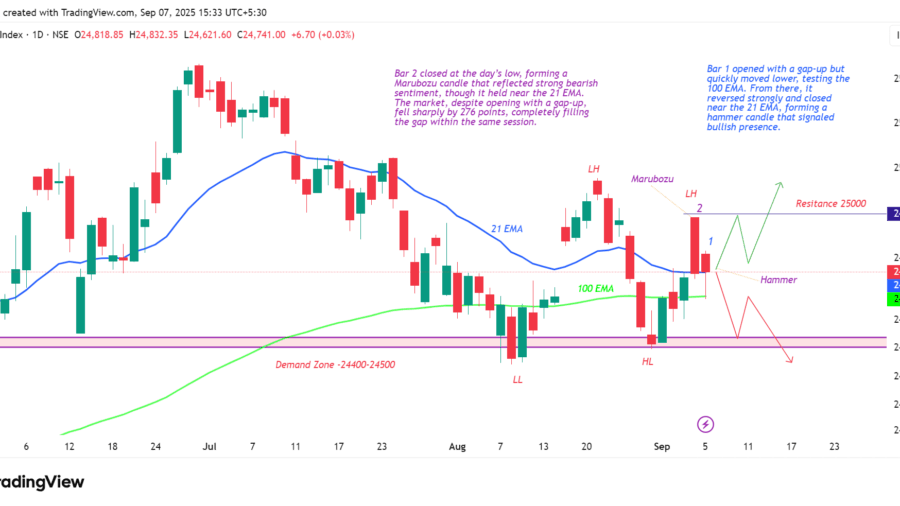

The Indian stock market is currently trading near 25,000.

From the all-time high of 26,357, the market has fallen nearly 1,400 points in just 21 days.

During this period:

- FIIs sold ₹40,704 crore in the cash market in 23 days,

- This is the highest FII selling seen in the last 5 months.

This sharp decline has raised an important question:

Why is the Indian market falling, and why are FIIs selling?

Key Reasons Behind the Market Fall

1. High Interest Rates in the US

The US Federal Reserve has kept interest rates high for a longer period.

Because of this:

- US bonds are giving safe and attractive returns.

- FIIs are shifting money from risky markets like equities to safer assets like bonds.

2. Strong US Dollar

A strong US dollar:

- Improves returns for foreign investors in dollar assets.

- Creates pressure on emerging market currencies like the Indian Rupee.

To avoid currency-related losses, FIIs reduce their exposure to Indian stocks.

3. Indian Stocks Became Expensive

The Indian market rallied strongly earlier.

- Many stocks became overvalued.

- Valuations moved above long-term averages.

FIIs, being valuation-driven investors, booked profits at higher levels.

4. Global Uncertainty

Global challenges such as:

- Slower economic growth,

- Geopolitical tensions,

- Ongoing global instability,

have increased risk aversion. In such conditions, investors prefer safety over growth.

5. Better Returns in US Bonds

US government bonds are currently offering good and near risk-free returns.

Compared to this, equity markets appear more volatile, leading to capital outflows from stocks.

Simple Conclusion

FIIs are not selling because India is weak.

They are selling because global money is temporarily moving toward safer assets.

This move should be seen as a healthy correction, not a market crash.

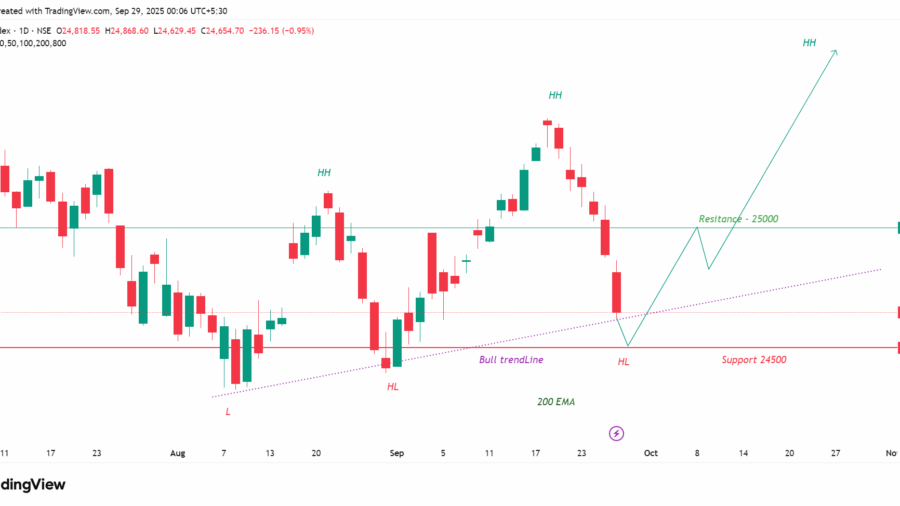

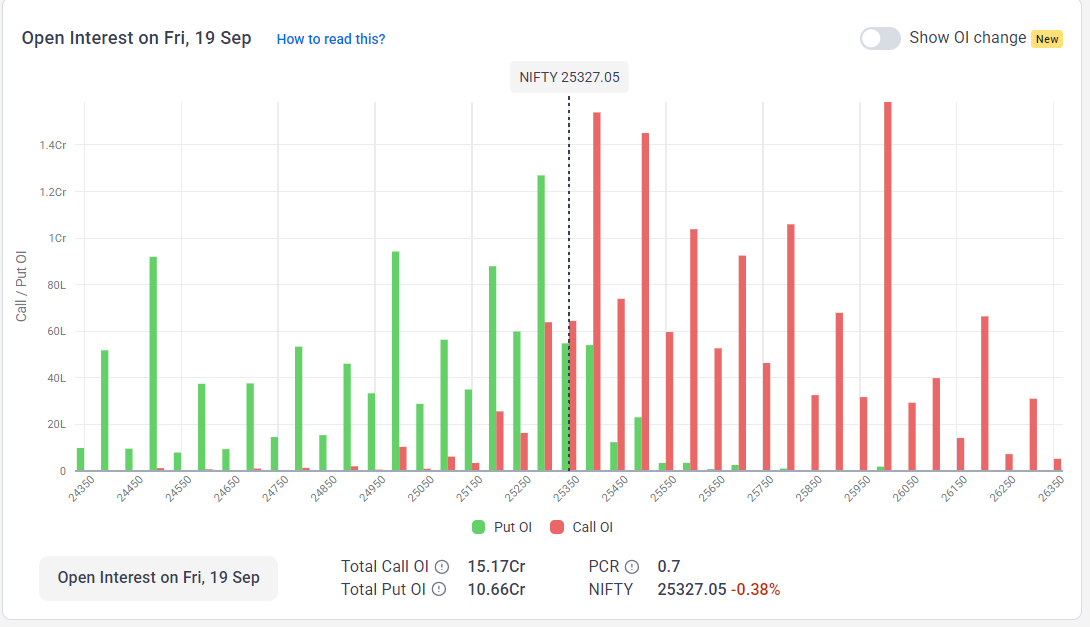

Trading View for Nifty 50 (Upcoming Weeks)

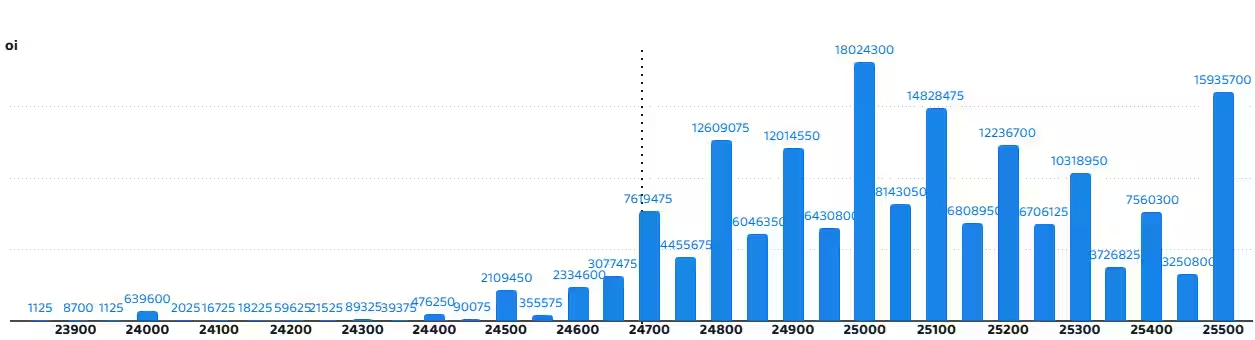

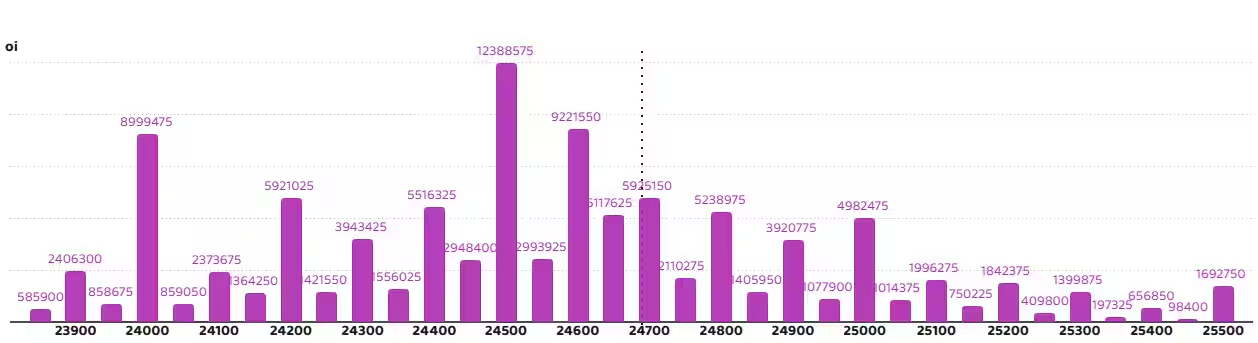

1. Day Trading in Options

- If the first 5-minute candle forms a bearish candle on Monday and closes below 25,000,a short position can be considered.

- First target: 24,900 (100 points).

- If the market fails to break 25,000:

Wait for the mid-day zone or post 2:30 PM.

If selling pressure is visible, take a short position.

Preferred options:

Buy ITM and ATM puts of 25,000 or 25,100.

2. Overnight / Positional View

- If the market breaks and sustains below 25,000:

Buy ITM and ATM puts.

First positional target: 24,500.

- Avoid OTM options for overnight holding, as theta decay reduces profitability.

Important Notes for Traders

- Hold positions only till 29 January (Friday).

On 1 February, the Indian Budget will be presented, which can change market direction sharply.

Fresh positions should be taken only after Budget clarity. - If the market opens bullish, avoid aggressive long positions.

In the current setup, upside moves may be temporary.

Bullish trades should be taken only after a clear breakout with strong follow-through.

Final Thought

Market corrections are part of every strong trend.

Trade with discipline, respect risk, and wait for price confirmation before taking positions.

Disclaimer: This content is for informational and educational purposes only and should not be considered as financial advice. Investing and trading in the stock market involve risks, and you should always consult a registered financial advisor before making any investment decisions. We do not accept any responsibility for losses that may arise from acting on this information.