Nifty 50 Trade Setup for September 8, 2025 & Next Week – Key Things to Know Before Market Opens

Technical View on Nifty 50 for 8 Sep

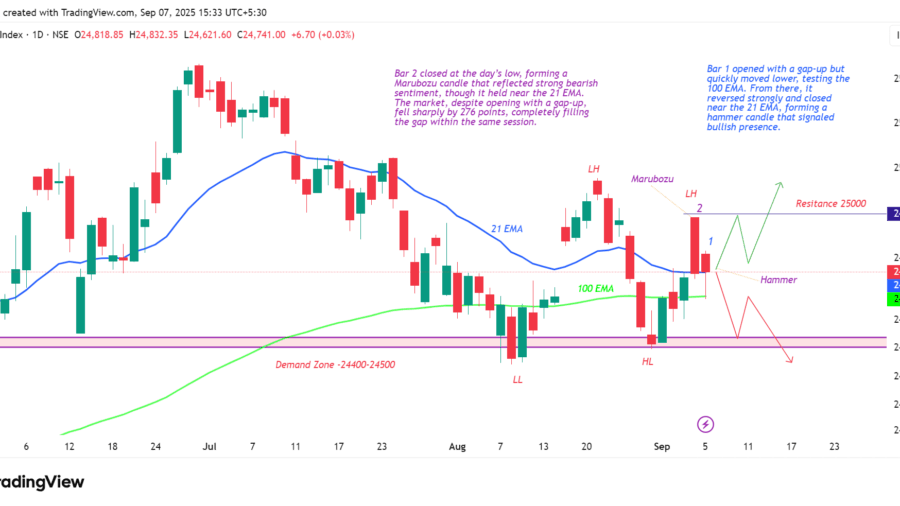

- Nifty closed at 24,741 on Friday. The session began with a gap-up opening but quickly slipped lower, testing the 100 EMA. From there, the index staged a strong reversal and ended near the 21 EMA, forming a hammer candle, which reflects a presence of buying interest and potential bullish sentiment.

- On the daily chart, the index is forming a Lower High – Higher Low – Lower Low (LH–HL–LL) pattern, which indicates weakness. This structure suggests that the market may once again test the 24,500 zone in the near term.

- If the index opens or trades above 24,800, it would break the previous day’s high, turning the short-term trend bullish. In this case, long positions can be considered with an immediate target of 25,000.

On the other hand, if the market opens gap-down below 24,600 and sustains under it, short-term bearish momentum may emerge. In such a scenario, short positions can be taken with downside targets of 24,600 and 24,500.

Open Interest Analysis – Nifty 50

Resistance Levels (Above 24,750)

- 24,800 – Around 1.14 Cr calls vs. 62L puts, indicating a minor resistance.

- 24,900 – Nearly 1.3 Cr calls vs. 22L puts, making this the second resistance level.

- 25,000 – A heavy buildup of 1.87 Cr calls against just 15L puts, establishing this as a major resistance zone.

Support Levels

- 24,700 – Around 76L puts vs. 60L calls. The difference is small, so this level can be breached quickly depending on Monday’s opening trend.

- 24,600 – With 98L puts vs. 26L calls, this is the second support zone.

- 24,500 – Strong buildup of 1.24 Cr puts vs. 27.88L calls, making it the major support level for the market.

Key Zones for Monday & Tuesday

- Support Zones: S1: 24,500 | S2: 24,600 | S3: 24,700

- Resistance Zones: R1: 24,800 | R2: 24,900 | R3: 25,000

Possible Market Scenarios

Bullish Setup:

- If Nifty opens flat or gap-up and sustains above 24,800, it may attempt to test 24,900.

- A strong breakout above 24,900 could push the index toward 25,000, but this zone carries heavy call writing and will act as a major hurdle.

- Sustained close above 25,000 can shift sentiment toward 25,200–25,300 levels.

Bearish Setup:

- If Nifty opens weak or slips below 24,700, the next immediate support lies at 24,600.

- A break below 24,600 may accelerate selling toward the 24,500 major support.

- Breach of 24,500 could extend downside toward 24,200–24,000 in the short term.

Put-Call Ratio (PCR)

The current PCR stands at 0.8, which means there are more calls written than puts. Typically:

- PCR below 1 signals bearish to neutral sentiment as call writers dominate, showing traders expect limited upside.

- PCR above 1 indicates bullish bias as more puts are written, reflecting confidence in market support.

At 0.8, the sentiment leans bearish to sideways, with resistance levels likely to hold unless there is strong buying momentum.

India VIX – Market Volatility Gauge

- Current India VIX: 10.8, which is at the lower end of the normal range (10–20).

- A low VIX reflects calmness and low volatility, meaning option premiums are cheaper.

- However, very low VIX levels often precede sharp moves in either direction if unexpected events or triggers occur.

In simple terms: the market is currently stable, but traders should be cautious of sudden volatility spikes.

Market Outlook

The index closed at 24,741 on Friday. For the upcoming week, especially with Monday trade and Tuesday’s expiry, these levels will be crucial:

- Bullish Scenario: If Nifty trades above 24,800 or opens with a gap-up, buyers may push it toward 24,900–25,000. A close above 25,000 could open room for 25,200–25,300.

- Bearish Scenario: If Nifty opens gap-down below 24,600 and sustains, weakness may extend toward 24,500. A break below 24,500 can accelerate selling pressure toward 24,200–24,000.

Trading Plan

- Long Entry: Above 24,800 with confirmation; target 24,900–25,000.

- Short Entry: Below 24,600 with confirmation; target 24,500 and then 24,200 if broken.

FII and DII data Analysis

Cash Market (01–05 Sep 2025)

- FIIs (Foreign Institutional Investors): Net sellers every day, with a total of -₹5,666 Cr (Month till date). Indicates FIIs are reducing exposure and showing bearish bias.

- DIIs (Domestic Institutional Investors): Net buyers consistently, with a total of +₹13,444 Cr (Month till date). DIIs are providing support and absorbing FII selling pressure.

Conclusion: FIIs are bearish in the cash market, but DIIs are counterbalancing with strong buying.

Index Futures (FIIs)

- FIIs are net sellers of -₹3,009 Cr (Month till date).

- Consistently reducing long positions or building short positions in futures.

- This adds to their bearish stance.

Index Options (FIIs)

- FIIs are net buyers of +₹26,489 Cr (Month till date).

- On daily data, they are alternating between heavy buying and selling, but overall leaning bullish on options.

- This could mean they are hedging shorts in cash/futures with long positions in calls or using spreads.

Market View

- FII Positioning: Bearish in cash and futures → they expect downside or at least limited upside.

- DII Positioning: Strong buying → they are supporting the market, possibly expecting stability or accumulation at lower levels.

- Options Activity: FIIs buying in index options → indicates hedging or preparing for volatility.

Possible Market Outlook

- Short-Term (1 week): Market may remain under pressure due to FII selling, especially if Nifty trades below 24,400.

- Support Levels: 24,400 and 25,000 (where DIIs might continue to provide support).

- Upside Risk: If Nifty crosses 24,800–25,000, short covering from FIIs in futures can trigger a sharp rally.

Trade Setup For Monday and Tuesday of 8 Sep 2025

1.Long Futures with Hedge Strategy

- Take a long position in Nifty September 30 Futures if the market trades above 24,800.

- Hedge this position by buying a Nifty 24,700 Put option (09 Sep expiry).

- Stop Loss for the futures trade is at 24,650.

- Target for the upside move is 25,000.

This setup is effective because if Nifty moves above 24,800, it confirms short-term bullish momentum, and the market is likely to extend toward 25,000. At the same time, the purchased 24,700 Put option acts as insurance, limiting potential downside risk if the market fails to hold the breakout and falls back.

By combining the futures position (for directional exposure) with a near-term protective put, you create a hedged long that balances profit potential with risk control.

2.Short Futures with Hedge Strategy

- Take a short position in Nifty September 30 Futures if the market trades below 24,600.

- Hedge this position by buying a 24,700 Call option (09 Sep expiry).

- Keep a Stop Loss at 24,750.

- The downside target is 24,400.

This setup works because if Nifty breaks below 24,600, it indicates weakness and opens room for further decline toward 24,400. The purchased 24,700 Call acts as insurance against a sudden bounce, thereby reducing the overall risk.

3.Naked Call Option Strategy

- If Nifty trades above 24800, buy 24600 CE or 24700 CE. These ITM calls hold intrinsic value and are better suited for overnight positions.

- For intraday trades, you may buy 24900 CE or 24500 CE as cheaper OTM calls. These can give quick returns if momentum continues, but are not suitable for holding overnight.

- Note: Avoid ATM and far OTM calls for overnight because they decay quickly in value and require a strong, immediate move to become profitable. ITM calls provide safer and more reliable exposure.

4.Naked Put Option Strategy

- If Nifty falls below 24600, buy 24800 PE for holding overnight, as ITM puts carry intrinsic value and offer safer positioning.

- For intraday trades, you can look at 24500 PE, since it has the highest OI and may move faster with momentum.

- Note: Avoid holding ATM or OTM puts overnight because they have no intrinsic value, and theta decay will quickly erode the premium if the market moves against you. Always factor in risk before taking the trade.

5.Bull Call Spread

If Nifty trades above 24800, initiate a Bull Call Spread with the following setup:

- Buy 24600 CE (9th Sep expiry) at ₹197

- Sell 25000 CE (9th Sep expiry) at ₹16.1

This strategy benefits from an upward move, with an immediate target near 24800. It helps capture the upside while keeping risk controlled.

6.Bear Call Spread Strategy in NIFTY

A Bear Call Spread is used when you expect limited downside or range-bound bearish movement. It involves selling a lower strike Call and buying a higher strike Call of the same expiry.

Sell 24700 CE and Buy 24900 CE

Why use it: Generates income when the market stays below the short strike, with limited risk. It is suitable if NIFTY trades below 24,600, with a possible target towards 24,400.

7.Long Straddle Strategy

The Long Straddle is an options strategy ideal when high volatility is expected in the market. It involves buying both a Call and a Put option at the same strike price and expiry.

Example:

- Buy 24700 CE (Call Option)

- Buy 24700 PE (Put Option)

- Expiry: 9th September

- Total Cost (Premium Paid): ₹13,009

Key Details:

- Maximum Profit: Unlimited (if NIFTY moves sharply in either direction)

- Maximum Loss: Limited to the premium paid (₹13,009)

- Breakeven Points: 24,527 (downside) & 24,873 (upside)

Why Use This Strategy: With expiry on Tuesday, the market is expected to see fast and significant moves on Monday and Tuesday. The Long Straddle benefits from strong moves in either direction, making it ideal for high volatility days.

8.Long Strangle Strategy

The Long Strangle is an options strategy designed for situations where a sharp market move is expected in either direction. It involves buying an Out-of-the-Money Call and an Out-of-the-Money Put with the same expiry.

Example:

- Buy 24850 CE at ₹47.3

- Buy 24650 PE at ₹38.5

- Expiry: 9th September

- Total Cost (Premium Paid): ₹6,435

Key Details:

- Maximum Profit: Unlimited (if NIFTY moves strongly in either direction)

- Maximum Loss: Limited to the premium paid (₹6,435)

- Breakeven Points: 24,564 (downside) & 24,936 (upside)

Why Use This Strategy: This strategy is ideal when the market is expected to be volatile and a significant move is likely. It works well during expiry weeks, major events, or uncertain market conditions, allowing you to profit from movement in any direction.

Disclaimer: This content is for educational purposes only and not financial advice. Options trading carries risk. Consult a registered advisor before making any trades. We are not liable for any losses.